Entrepreneur?

What does the new retirement savings plan have in store for you?

Under the so-called "Pacte" law of May 22, 2019, the public authorities have reformed retirement savings to make them more attractive. They unified the various existing savings products into a single product: The Retirement Savings Plan (PER).

Marketed since October 1, 2019, it is intended to be more flexible and better suited to the professional career of policyholders.

Overview of its main characteristics

A COMPARTMENTAL PRODUCT

The purpose of the Retirement Savings Plan is to bring together the current supplementary retirement savings products.

To do this, it has two compartments:

- an individual compartment (we speak of PERIN) which replaces the Perp and the Madelin contract.

- a collective compartment, itself subdivided into two products: the collective company retirement savings plan (PERCOL) and the compulsory company retirement savings plan (PERO).

The first product (PERCOL), which replaces Perco, is open to all employees. A seniority condition may be provided for, but it must not exceed 3 months. This plan will be funded by amounts from employee savings (incentive and profit-sharing), by voluntary payments by the holder, by days of leave entered in the time-savings account and by contributions from the company.

The second product (PERO), which replaces the Article 83 contract, can be reserved for one category of employees only. He will receive the voluntary contributions of the holder, the days of leave registered in his time savings account as well as the compulsory contributions of the employee or the employer.

FEEDING THE CONTRACT

To build up capital, the insured may, during his activity, fund his PER freely by one-off payments and / or regular payments according to the chosen frequency (monthly, quarterly, annually).

This savings will be invested in various media selected by the financial institution. The insured may, for his part, choose between low-risk assets (funds in euros, for example) and different categories of financial support (OPCI, SCPI, FCPE, units of account, etc.).

A sufficiently large panel to allow good diversification of its contract. Interest of the PER, the amounts saved will be fully portable from one compartment to another. The supplementary pension will thus be better adapted to the career paths of the insured.

Note that the “old” retirement savings products (Perp, Madelin, Préfon, Corem, Perco, article 83, etc.) can no longer be taken out as of October 1, 2020. Policyholders who currently have them can either continue to use them. operate or transfer the savings accumulated on these products within a retirement savings plan subscribed for the occasion. This possible choice of transfer must be accompanied by a counsel.

SAVINGS MANAGEMENT

To help policyholders in the management of their retirement savings, financial institutions will have to offer them "horizon management".

Concretely, it is about managed management in the PER. It is offered by default to every saver.

This management allows assets to be entrusted to professionals for personalized management according to the investor client profile and market conditions, while securing these investments on funds in euros as the saver approaches. of retirement.

This managed management will also have to offer three investment profiles with different levels of risk:

- a cautious profile,

- a balanced profile,

- a dynamic profile.

But if they wish, the insured can choose to manage their contract on their own and make their own asset allocation.

EXIT OF THE SAVINGS

At the time of retirement, the Retirement Savings Plan leaves the policyholder the choice of how to withdraw from the savings.

The latter may opt, both for voluntary savings and for employee savings, for the receipt of either a capital or a life annuity.

The amounts relating to compulsory contributions can only be the subject of a life annuity.

Important clarification: although savings are blocked until retirement, the PER provides, as for Perp or Madelin, cases of early release: death of the spouse, 2nd or 3rd category disability of the insured. , his spouse or his children, over-indebtedness, expiry of unemployment rights, cessation of activity following a judicial liquidation and purchase of the main residence.

THE DEATH OF THE INSURED

In the event of premature death of the insured, the PER will be closed and the accumulated savings will be transmitted, in the form of capital or annuity, to his heirs or to the beneficiaries designated in the contract.

These amounts will therefore integrate the estate assets.

However, when the PER has been opened with an insurer (and not an asset manager), the sums paid will fall under the advantageous tax regime for life insurance (tax regime for life insurance adjusted solely depending on the age of the insured at the time of death).

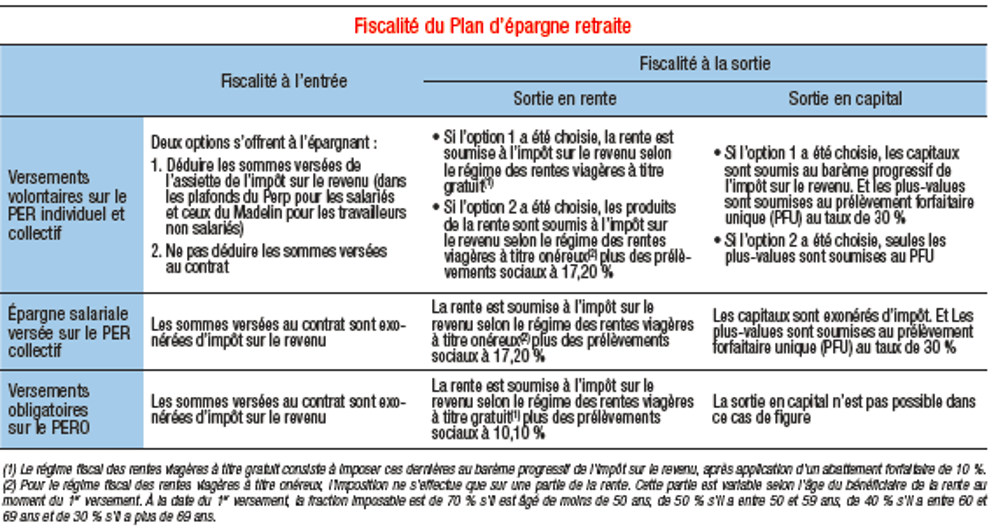

THE PER BENEFITS FROM A FAVORABLE TAX REGIME